5 Minutes

CoinShares posts largest weekly net inflows in history

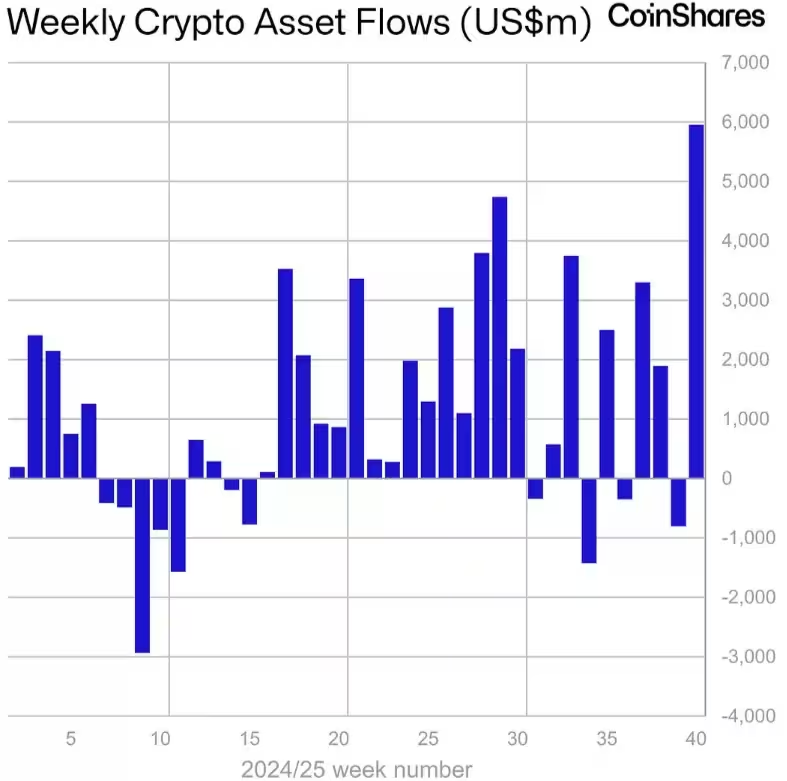

CoinShares reported a net inflow of $5.95 billion into digital asset investment products last week, marking the largest weekly inflow on record. The dramatic reversal came after nearly $1 billion in outflows the prior week and helped push total crypto assets under management (AUM) to a new all-time high.

Key highlights

- Total net inflows: $5.95 billion

- U.S. contribution: $5.0 billion, a weekly record

- Global crypto AUM: $254 billion (all-time high)

- Bitcoin weekly inflows: $3.55 billion

- Ethereum year-to-date inflows: $13.7 billion

- Solana weekly inflows: $706.5 million; YTD: $2.5 billion

Drivers behind the surge

CoinShares research head James Butterfill attributes the sudden spike in digital asset investment products to a mix of macroeconomic and geopolitical factors. Butterfill points to weak employment data, a delayed market reaction to expectations of an FOMC interest rate cut, and investor concerns over recent U.S. government instability as primary catalysts for positioning into crypto products.

CoinShares’ chart depicting a new record for weekly inflows into digital asset investment products

The firm noted that a large portion of the inflows originated in the United States, where investors allocated roughly $5 billion into crypto funds last week. Switzerland set a new weekly record with $563 million, while Germany recorded its second-largest weekly inflow at $311.5 million. Most countries on CoinShares' list saw positive net inflows, with Sweden as a notable exception recording $8.6 million in outflows.

Bitcoin leads asset-class inflows

Bitcoin remained the dominant recipient of investor capital, attracting $3.55 billion in weekly inflows and bringing year-to-date flows to $27.5 billion. These inflows coincided with BTC reaching a fresh market high near $125,506, reflecting sustained institutional demand for bitcoin exposure via regulated products such as ETFs and other investment funds.

CoinShares emphasized that despite strong inflows and record prices, there was no corresponding uptick in short-product purchases backed by Bitcoin. That suggests most institutional flows favored long exposure to BTC rather than hedged or inverse strategies.

Ethereum and Solana performance

Ethereum funds saw $1.48 billion in inflows last week. While not a new weekly record, these allocations helped ETH net inflows reach a year-to-date record of $13.7 billion, about triple the inflows seen over the same period last year according to CoinShares. The strong demand highlights continued institutional interest in Ethereum exposure ahead of ongoing network upgrades and DeFi growth.

Solana also recorded a breakout week, with $706.5 million in inflows — its largest weekly inflow on record — lifting Solana's year-to-date inflows to $2.5 billion. XRP and several other altcoins registered smaller but notable inflows, with XRP attracting $219 million over the week.

Market impact and outlook

The influx of capital into digital asset investment products pushed overall crypto assets under management to $254 billion, a new peak for the sector. Such rising AUM typically signals growing institutional confidence and increased adoption of crypto ETFs and structured products as mainstream portfolio allocations.

Analysts caution that these flows can be sensitive to macro news, including employment reports, central bank actions, and political developments. The recent U.S. government shutdown and weak ADP payroll data were cited as immediate triggers that accelerated investor allocation to crypto funds.

What this means for investors

- Institutional demand is a meaningful driver of price momentum for major crypto assets, particularly Bitcoin and Ethereum.

- Record weekly inflows increase the probability of continued ETF adoption and product innovation in digital asset investment strategies.

- Market watchers should monitor macroeconomic indicators and regulatory developments, as these remain primary catalysts for rapid shifts in fund flows.

Overall, CoinShares' latest fund flows report underlines a renewed wave of capital entering the crypto sector, led by Bitcoin, Ethereum, and Solana. For investors and asset managers, the data reinforces the growing role of regulated investment products and ETFs in channeling institutional allocations into digital assets.

Source: crypto

Leave a Comment