3 Minutes

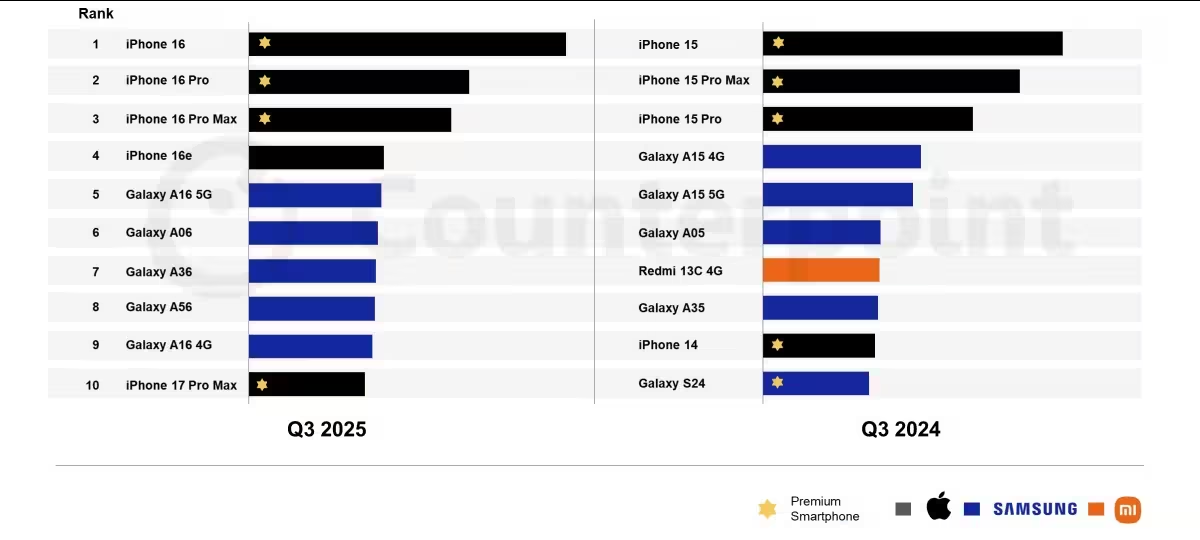

Apple dominated Counterpoint Research’s global best-seller list for Q3 2025 — but it wasn’t the freshly launched iPhone 17 models that led the pack. Instead, the iPhone 16 claimed the top spot, showing how a well-priced, well-promoted model can still outshine newer releases.

iPhone 16: steady demand, big impact

Counterpoint’s data shows the iPhone 16 accounted for roughly 4% of all smartphone shipments between July and September 2025. The device performed especially strongly in India, where festive-season promotions gave it a clear sales boost, and it also registered a recovery in Japan after a softer period for Apple.

Apple’s success wasn’t limited to a single SKU. The iPhone 16 Pro, 16 Pro Max and the more affordable iPhone 16e also ranked highly, filling the second through fourth positions on the global best-seller list. That echoes last year’s pattern when the iPhone 15 family dominated the top three.

Samsung’s A-series holds ground

Samsung was the only non-Apple brand to place handsets in the top ten. Its entry-level Galaxy A16 5G and Galaxy A06 landed fifth and sixth, respectively, while midrange A36 and A56 models appeared in seventh and eighth. Another Galaxy A16 variant appeared again in the ninth position, reflecting strong demand for Samsung’s budget and midrange portfolio.

Interestingly, the recently released iPhone 17 Pro Max managed to crack the top ten despite limited availability, arriving toward the end of September. That early demand suggests strong interest out of the gate, even if supply constraints kept its market share lower than the iPhone 16 family.

What this ranking reveals

- Brand loyalty and ecosystem strength continue to favor Apple: multiple iPhone 16 variants dominated the chart, not just a single model.

- Promotions and localized pricing matter: festival deals in India materially lifted iPhone 16 sales during the quarter.

- Samsung’s volume comes from breadth: several A-series models across price bands kept the brand competitive in global unit rankings.

For Apple, the Q3 outcome shows that incremental upgrades plus smart regional marketing can yield strong sales even when newer flagships are on the way. For competitors, it’s a reminder that wide-reaching value models still capture substantial market share around the world.

As we move into the holiday quarter, watch whether the iPhone 17 lineup gains ground as availability improves, or if the 16 lineup keeps momentum through deals and carrier incentives. Either way, Counterpoint’s snapshot highlights that the smartphone market remains dynamic — and that the newest phone isn’t always the best-selling one.

Source: gsmarena

Leave a Comment