6 Minutes

Summary: Crypto networks begin quiet preparations

Quantum computers cannot break Bitcoin or other major blockchains today, but several projects are taking steps to prepare for a future in which quantum attacks might become feasible. This divergence in approach — with many altchains moving forward on post-quantum upgrades while Bitcoin’s ecosystem argues over timing and messaging — has sharpened investor concerns and driven a broader debate about how to manage long-term cryptographic risk.

Why some blockchains are moving now

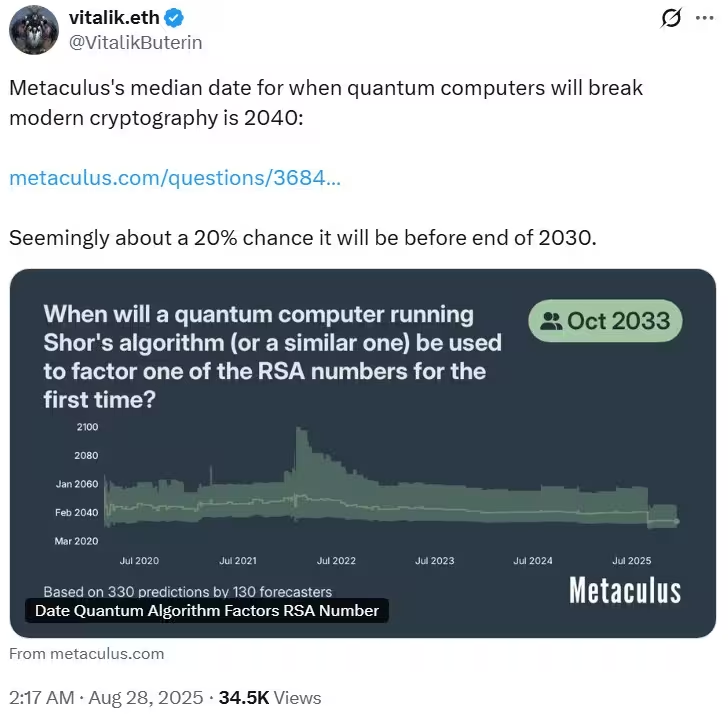

Ethereum’s leadership has reframed quantum computing from a speculative threat into an engineering challenge that merits early planning. Vitalik Buterin and other researchers argue that even a low-probability outcome is worth addressing early when migration timelines can stretch for years and the cost of a mistake is high. Forecasting studies cited by proponents suggest a non-trivial chance that quantum machines capable of undermining current public-key cryptography could appear well within decades — making early technical work and testing prudent.

Prediction models forecast a 20% chance that powerful quantum computers are about five years away.

Opt-in strategies and testnets

Networks that can iterate quickly are largely treating quantum-resistance as optional infrastructure: opt-in account-level upgrades, hash-based signatures and experimental testnets let developers validate approaches without disrupting existing wallets or protocols. For example, Aptos has published a proposal to add post-quantum signature support at the account layer via an opt-in mechanism so users who want additional protection can adopt it while others keep their current keys.

Solana recently partnered with post-quantum security firm Project Eleven to run a testnet using quantum-resistant signatures. The goal is to determine whether these algorithms can be integrated without compromising throughput or compatibility with existing tooling.

Quantum resistance is increasingly being treated as a due diligence consideration by investors.

Why Bitcoin’s conversation is more fraught

Bitcoin’s monetary value is tightly linked to perceptions of long-term security. The protocol currently uses elliptic curve cryptography (ECC) to verify ownership: a public key is visible onchain only when an address has been used, while control rests in the private key. In theory, a sufficiently powerful quantum computer running Shor’s algorithm could derive a private key from a public key, enabling undetectable theft — the coins would simply move as if the owner had spent them.

This technical possibility underpins a broader trust issue: even if quantum-capable machines remain years away, the appearance of complacency or denial among influential Bitcoin developers can affect investor confidence. Some market participants link hesitant messaging to downside pressure on BTC markets.

Some investors say dismissing quantum risk is affecting Bitcoin’s price.

The two camps inside Bitcoin

On one side are developers and cryptographers who caution against treating quantum computing as an imminent emergency. They stress current quantum hardware cannot break ECC at scale and warn that alarmist rhetoric creates unnecessary panic and bad market signaling. Blockstream CEO Adam Back has repeatedly characterized practical quantum attacks as decades away and has criticized amplification of the risk as counterproductive.

On the other side are investors and policy researchers who say even low-probability, high-impact risks matter for an asset whose appeal is built on long-term certainty. Venture and research figures such as Nic Carter and Craig Warmke argue that dismissing or downplaying the risk could prompt capital to diversify away from Bitcoin and force a reactive scramble if the threat accelerates.

These opposing views explain why tentative measures like Bitcoin Improvement Proposal 360 — which would introduce quantum-resistant signature choices — attract outsized attention. Supporters view early exploration as prudent signaling and risk reduction; critics worry the debate itself can erode confidence.

Technical realities and migration pathways

Practically speaking, migrating a global cryptocurrency to post-quantum cryptography is a complex multi-year effort: it involves client and wallet updates, signature scheme standardization, ecosystem coordination, and careful migration of funds so users aren’t exposed. That’s why many projects opt for incremental strategies — opt-in accounts, layered upgrade paths and trial deployments — that let ecosystems build experience without forcing a hard fork or rekeying of all addresses.

Where opt-in and standard approaches differ

Opt-in designs let users adopt quantum-resistant keys at their discretion. This reduces immediate disruption and preserves existing cryptographic guarantees for legacy accounts. In contrast, a mandatory migration or network-wide enforcement could be interpreted as a signal that the protocol’s current security is compromised — which could have short-term market consequences even if the technical threat is still remote.

What investors and developers should watch

Key indicators to monitor include advances in quantum hardware milestones, successful public cryptanalysis using quantum algorithms (if any), and progress in standardizing post-quantum signature schemes that are performant and interoperable. Projects that publish clear roadmaps, test results and upgrade plans tend to reassure markets while preserving flexibility if timelines shift.

For Bitcoin, the debate is as much about communication as it is about engineering. The community must balance transparent contingency planning with careful messaging to avoid creating unwarranted panic that could undermine confidence in the system’s long-term resilience.

Conclusion: managing long-term cryptographic risk

Quantum computing poses a theoretically severe but presently distant threat to public-key cryptography. Many blockchains — especially those that can iterate quickly — are already experimenting with post-quantum signatures and opt-in upgrades to future-proof their infrastructure. Bitcoin remains split between those who prefer to downplay near-term risk to avoid market disruption and those who favor proactive contingency planning to sustain investor trust.

Ultimately, the situation is evolving: engineering work, testnets and careful communication can coexist. The most constructive path for the industry is to continue rigorous research, deploy measured opt-in solutions where feasible, and keep markets informed without amplifying fear. That balanced approach helps protect the ecosystem’s security and investor confidence as quantum technologies mature.

Source: cointelegraph

Comments

labnix

Early opt-in is smart but if wallets dont support PQ keys ppl wont adopt. Tests should measure UX and throughput, not just crypto flex.

blockflux

Wait, so Bitcoin devs are downplaying quantum while altchains add post-quantum keys? Feels like a risky PR play. Is timeline really decades?

Leave a Comment