3 Minutes

Bitcoin momentum builds toward new highs

Bitcoin (BTC) is closing in on fresh all-time highs as price action holds above key support and open interest climbs. The market structure remains bullish: BTC has preserved a sequence of higher highs and higher lows inside its long-term trading channel, and momentum is accelerating as traders and institutions increase exposure.

Key technical levels to watch

BTC is testing the $123,348 resistance zone — the last significant barrier before a potential breakout into blue-sky territory. If bulls reclaim and sustain gains above that level, the next logical target inside the channel is around $131,000, which aligns with the upper channel resistance. These levels are critical for traders planning entries, stop placement, and risk management as volatility typically spikes in new-high regimes.

BTCUSDT (1D) Chart

Trading channel and structure

The uptrend remains structurally intact. Each corrective leg has respected the channel's lower boundary, often coinciding with on-chain and order-book concentration points. The most recent bounce off the channel low — where the point of control clustered — provided a clean launchpad for the run into the $123,348 zone. That controlled behavior suggests the rally is being built on sustainable demand rather than purely speculative thrusts.

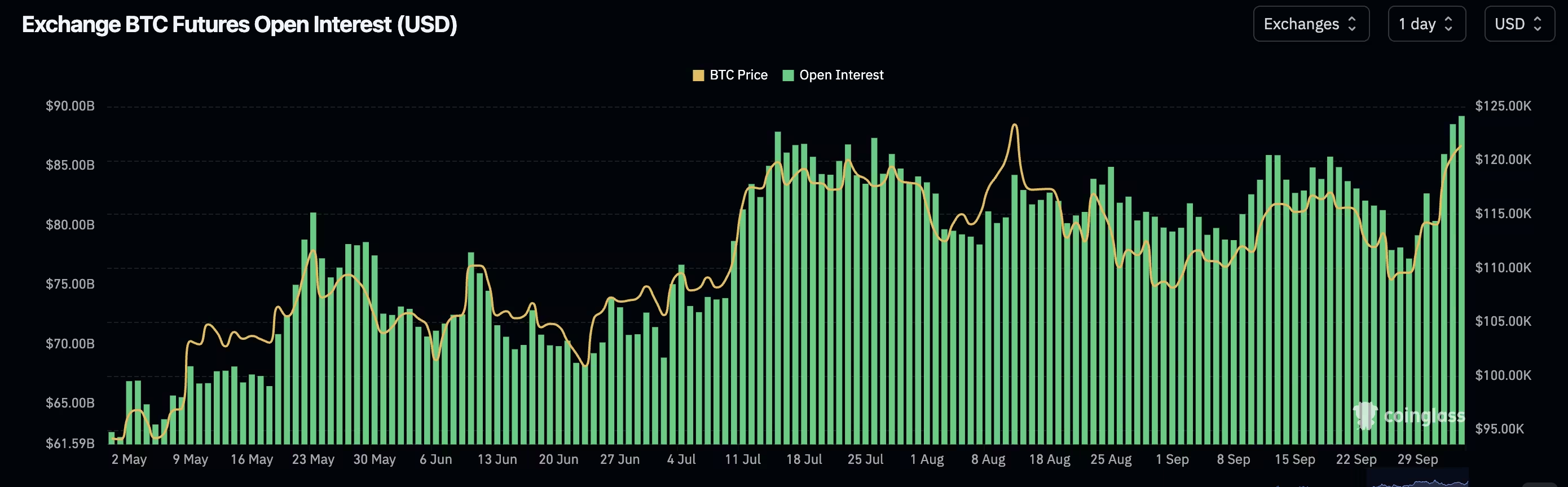

Open interest confirms growing participation

Open interest is rising alongside price, a bullish confirmation that more capital and leverage are entering the market. When open interest expands with price appreciation, it typically indicates fresh buying rather than shorts being squeezed. This alignment has historically preceded strong continuation moves in BTC, and current readings support the case for further upside.

BTC Open Interest

Institutional demand and market confidence

Institutional commitment appears notable: strategy-level Bitcoin allocations have climbed, with reported holdings rising to roughly $77.4 billion as BTC moved back above $120,000. Institutional flows and large-wallet accumulation add credibility to the rally and reduce the likelihood that this is a short-lived spike. Some Wall Street forecasts — though speculative — have also turned ambitious, with upside scenarios extending well beyond six figures in the event of a sustained breakout.

What traders should expect next

Overall, the bias is bullish across price structure, market structure, and derivatives activity. A decisive close above $123,348 would likely accelerate momentum toward the $131,000 channel resistance. Traders should prepare for increased volatility if a blue-sky breakout occurs: liquidity tends to thin above prior all-time highs and swings can be sharp in either direction.

Risk management and strategy

Plan entries with defined risk, use position sizing that accounts for elevated volatility, and consider scaling into exposure as the breakout confirms. Watch open interest and on-chain flows for confirmation: sustained increases in both metrics alongside price gains typically indicate higher-probability continuation. Conversely, if price rejects $123,348 and open interest drops, it may signal a short-term exhaustion and call for more conservative positioning.

In sum, Bitcoin’s technical setup, rising open interest, and institutional involvement create a favorable environment for continued upside. Market participants should stay alert to breakout cues while managing risk for the heightened volatility that often accompanies price discovery above prior all-time highs.

Source: crypto

Leave a Comment