5 Minutes

Bitcoin cools after new $125K all-time high

Bitcoin staged a fresh record, briefly topping $125,000 before pulling back, leaving traders and analysts debating where the next BTC price bottom may form. The sudden spike and subsequent retreat underline the extreme weekend volatility often seen across crypto markets as liquidity thins and derivatives desks move the dial.

BTC/USD one-hour chart

Short-term technicals and possible retracement targets

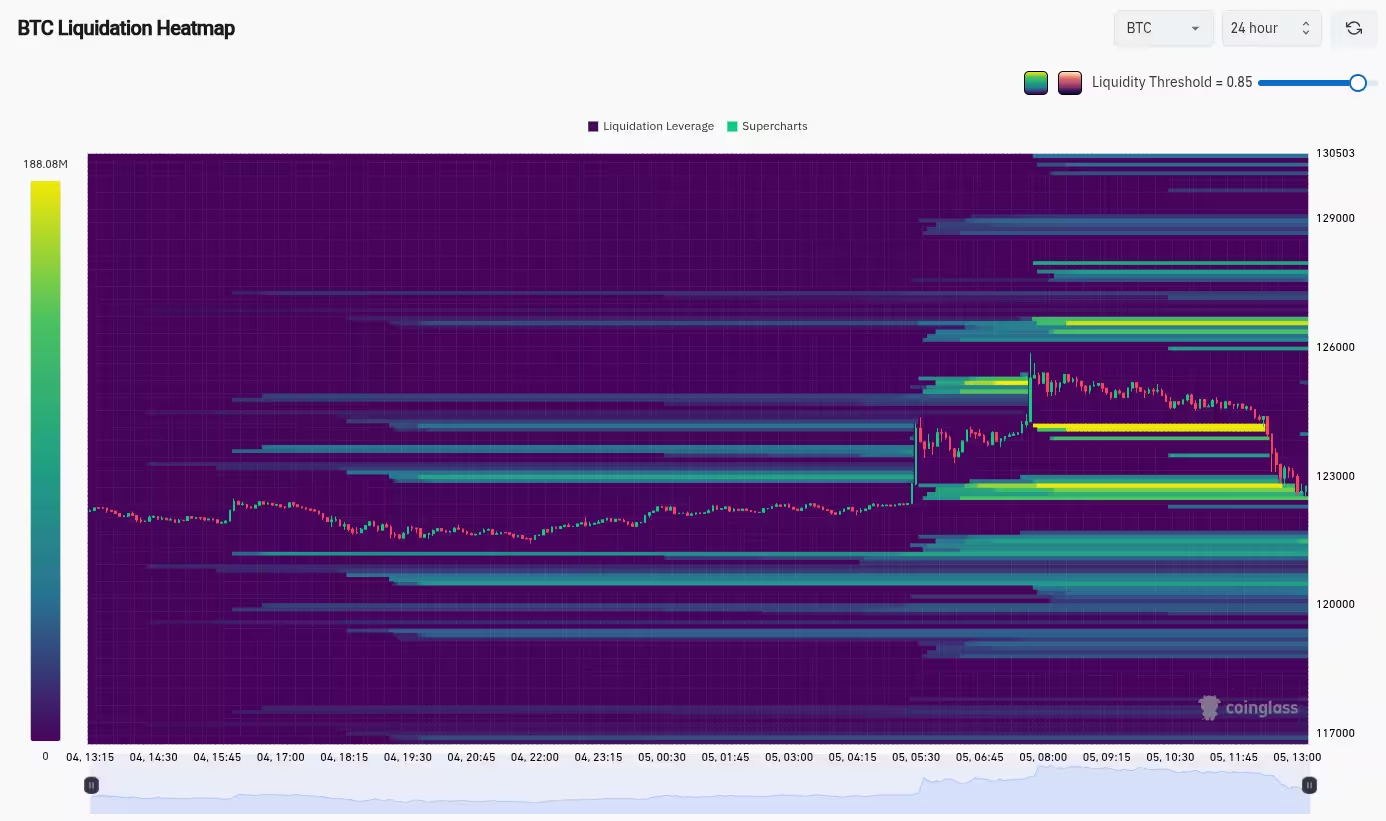

Data from major charting platforms showed BTC sliding back under $123,000 after the weekend surge. Derivatives-driven moves were a key factor in the rally and the quick reversal, and some market participants warned the push higher could have been designed to trap long positions.

What traders are watching

On lower timeframes, liquidity looked to be sapped near the highs, with order books revealing both buy-side and sell-side stops being hit as price oscillated. Popular traders pointed to the risk that this move was "bait" aimed at enticing leveraged longs into poorer exits before a larger retracement.

BTC liquidation heatmap

Exponential moving averages as potential support

Several analysts flagged the 50-period exponential moving average (EMA) on the four-hour chart as a likely first support zone, currently sitting just above $118,000. Historically, retests of the 4h 50 EMA have preceded renewed upward momentum in similar market conditions, which makes it a useful reference for traders allocating long exposure.

BTC/USDT four-hour chart with 50EMA

How deep could the pullback go?

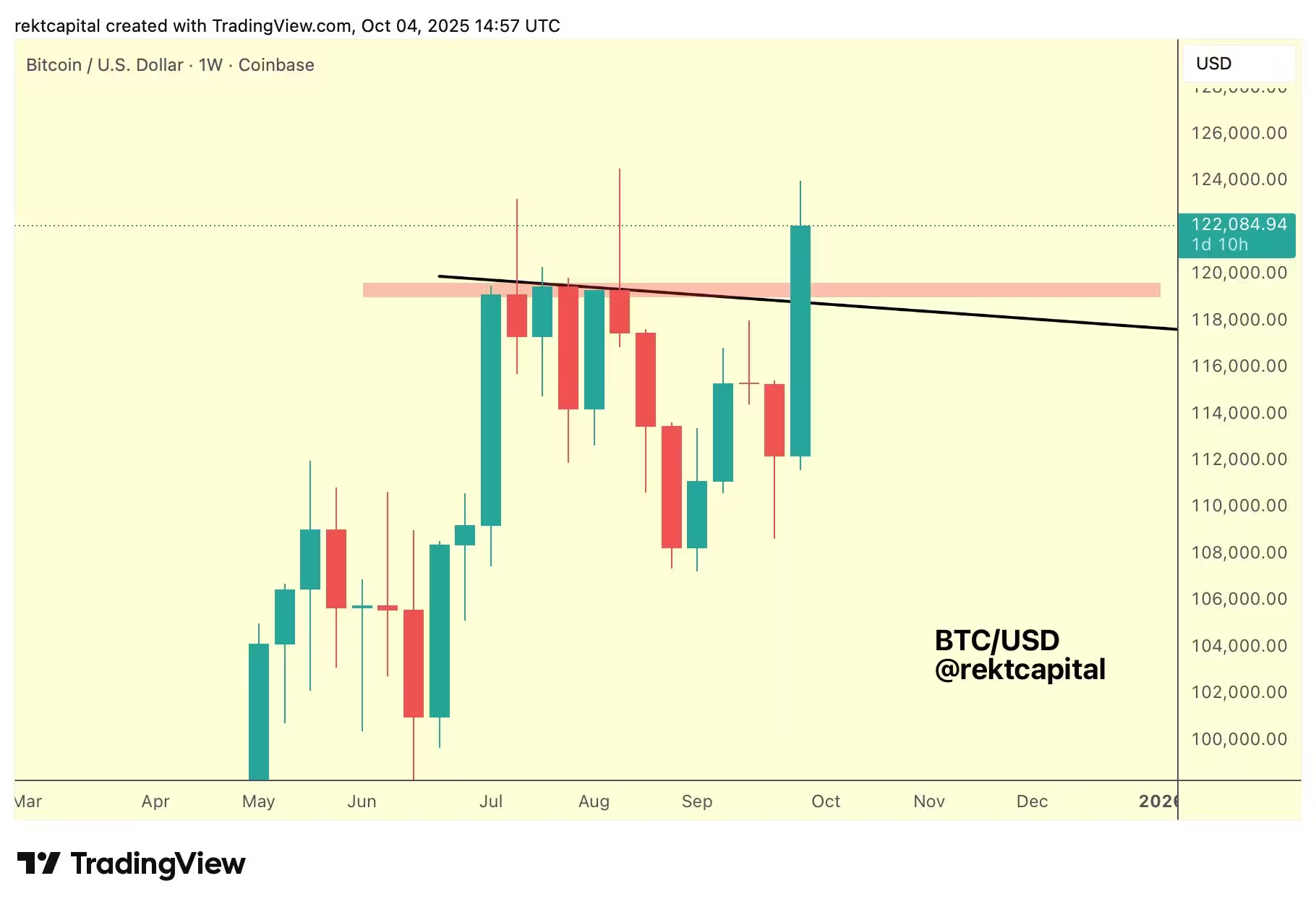

Using historical analogues, some analysts suggest that a drawdown of up to around 4% would still be consistent with an intact weekly uptrend—meaning a modest correction should not yet signal a reversal of the broader bullish narrative. Others remind the market that prior rejections from the $124k level led to deeper pullbacks, so patience and risk management remain essential.

BTC/USD one-week chart

Scenario planning

Short-term traders may target the 4h 50 EMA near $118k for entries, while swing traders will be watching whether $124k transforms from resistance into a confirmed support zone on subsequent attempts. A failure to hold key support could open the door to a larger correction, whereas successful retests may validate continued institutional accumulation.

Institutional demand and the so-called 'debasement trade'

Alongside technical analysis, market commentary has increasingly pointed to institutional flows as a guiding force behind recent BTC strength. Large, sustained bids and limited pullbacks often indicate participation from allocators seeking crypto as a hedge against fiat debasement.

Financial research and mainstream commentators continue to use the term debasement trade to describe investor behavior that treats Bitcoin as digital gold—an asset that can preserve purchasing power as central bank policies and currency dilution weigh on fiat valuations. This narrative has been reinforced by major banks and institutions publishing bullish outlooks and price targets for the asset class.

What this means for traders and investors

For active traders, the current environment underlines the importance of monitoring liquidity, derivatives positioning, and moving-average support levels. For longer-term investors, continued institutional interest reinforces the thesis of Bitcoin as an inflation hedge and store of value, though volatility remains a core characteristic.

Key takeaways

- Bitcoin reached new all-time highs above $125,000 before a rapid retracement back below $123,000.

- Weekend rallies are often less liquid and can be unreliable signals; traders expect whipsaw price action.

- Technical traders are watching the 4h 50 EMA (near $118k) and $124k as critical levels for the next BTC bounce.

- Institutional flows and the broader debasement trade narrative continue to provide bullish structural support for Bitcoin.

As BTC navigates the post-ATH landscape, a blend of technical caution and macro awareness will be crucial for anyone following price action. Traders should plan entries around confirmed retests and manage leverage carefully, while investors should consider how Bitcoin fits into broader portfolios given ongoing currency debasement concerns and institutional interest.

Source: cointelegraph

Leave a Comment