4 Minutes

Stablecoins See a Massive Q3 Inflow as Demand for Dollar-Pegged Assets Rises

Stablecoins recorded more than $45 billion in net inflows over the past 90 days, underscoring a renewed appetite for US dollar–pegged crypto assets. Data from RWA.xyz shows that the third quarter saw net minting jump dramatically from roughly $10.8 billion in Q2 to $45.6 billion in Q3 — a 324% surge concentrated in a handful of major issuers and a fast-growing algorithmic entrant.

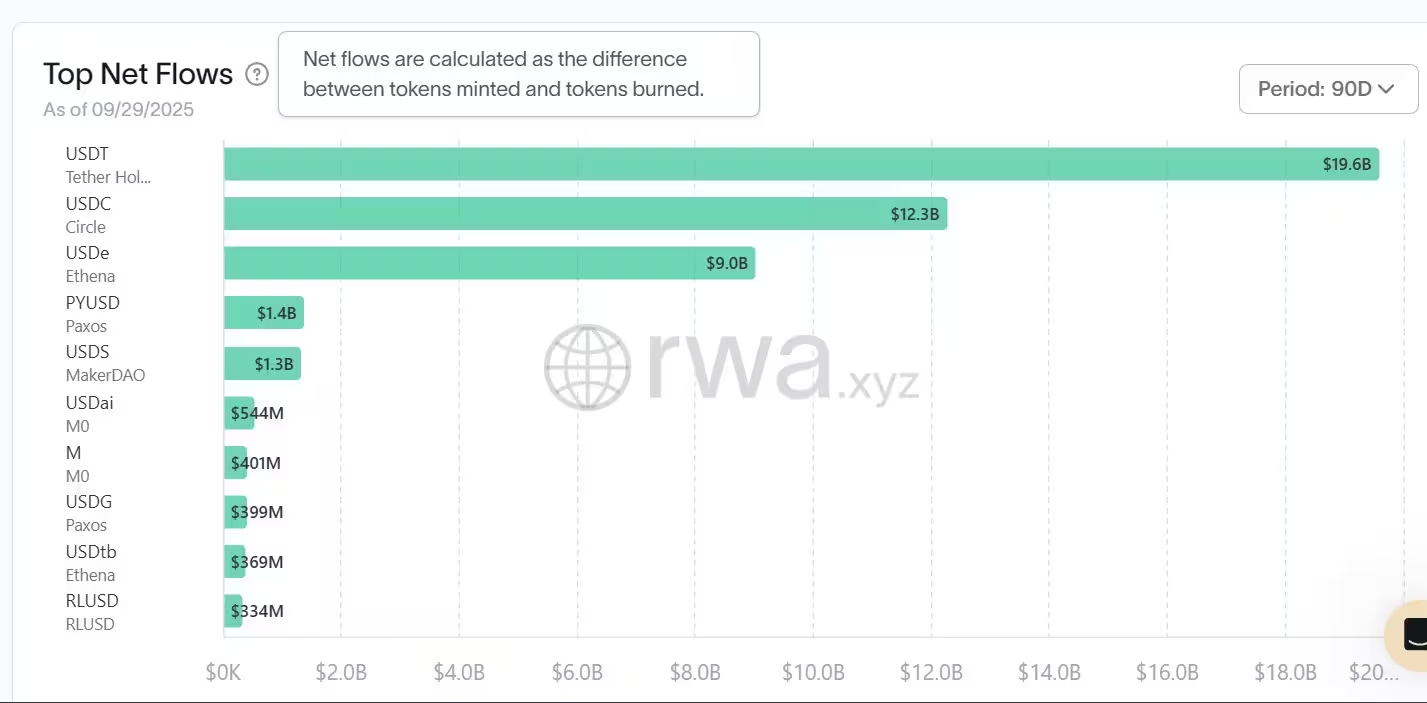

Top performers: USDT, USDC and Ethena’s USDe

Tether’s USDT led the quarter with $19.6 billion in net inflows, making it the dominant stablecoin by issuance during Q3. Circle’s USDC followed with $12.3 billion of net minting, after a nearly negligible issuance in the prior quarter. A notable newcomer, Ethena’s synthetic stablecoin USDe, contributed roughly $9 billion in net inflows during the quarter, reflecting growing interest in algorithmic and synthetic dollar alternatives.

Other issuers also recorded notable gains: PayPal USD (PYUSD) added around $1.4 billion in net inflows, while MakerDAO’s USDS saw $1.3 billion. Emerging projects such as Ripple USD (RLUSD) and Ethena’s USDtb reported steady, smaller-scale increases as the market for diversified stablecoin options expands.

Stablecoin net flows and what they mean

Net inflows measure the difference between stablecoins minted and those redeemed in a given period. Positive net inflows indicate expanding circulating supply and growing demand for dollar-pegged tokens, which market participants use for trading, DeFi liquidity, on-ramps and treasury management. The Q3 spike signals renewed confidence in stablecoin utility despite ongoing regulatory scrutiny and market volatility.

Stablecoin net flows in the last 90 days

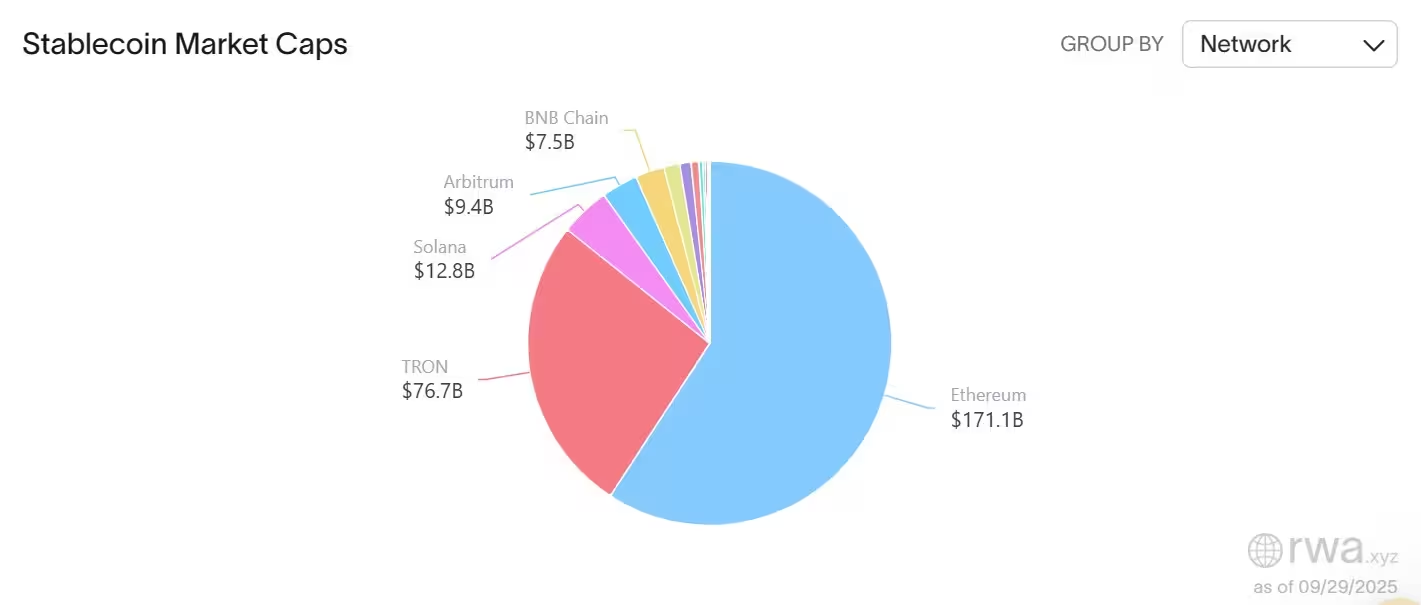

Network distribution: Ethereum remains dominant

Network-level data show Ethereum remains the largest host for stablecoins, with about $171 billion in circulating stablecoin supply, according to RWA.xyz. Tron is the second-largest network with roughly $76 billion. Other chains — including Solana, Arbitrum and BNB Chain — collectively host about $29.7 billion.

Stablecoin market capitalization by network

Market share and capitalization

By token, Tether’s USDT accounts for nearly 59% of the stablecoin market, while Circle’s USDC holds roughly 25%, per DefiLlama. Ethena’s USDe has captured close to 5% of the market amid its rapid issuance. Combined data from RWA.xyz and DefiLlama place the overall stablecoin market cap around $290 billion over the past 30 days.

Activity indicators diverge from supply growth

Despite the substantial rise in market capitalization and net issuance, some activity metrics weakened. RWA.xyz reports monthly active addresses fell to 26 million — down about 22.6% month-over-month — while transfer volume dropped to $3.17 trillion, an 11% decline. These mixed signals suggest that while liquidity and supply have expanded, on-chain user engagement and transaction velocity have softened recently.

Implications for traders, treasuries and DeFi

For traders and DeFi participants, larger stablecoin pools typically improve liquidity and trading efficiency across exchanges and AMMs. Corporate treasuries and retail users may view increased issuance as a sign of deepening market utility. However, regulators and risk managers are likely to scrutinize the concentration of supply among a few issuers and the rapid ascent of algorithmic solutions like USDe.

As the stablecoin ecosystem grows, market observers will be watching whether issuance remains broad-based or concentrates further, how cross-chain liquidity evolves, and whether on-chain activity recovers to match the surge in supply.

Source: cointelegraph

Leave a Comment